Some time ago, we talked about the top best money management apps. In this guide, we will pay more attention to the top money-saving Android apps. Now, do notice that money management apps do a form dual as money-saving apps since you are able to control your expenditures with good precision. There are some save money apps out there that are focused on saving money, however, which explains the reason why we’ve established another list for all those.

You’ll come across some interesting apps on this listing. A number of them do have a whole lot in common, although others are somewhat different. That having been said, you’ll find nine apps given below, plus they are not laid out in any specific order. You will have the ability to have the links to them, together with a few screenshots, descriptions, and other relevant info.

Top 9 Best Money-Saving Android Apps 2021

Below is a bit more info on apps to save money app, a proposal for the kind of user that the app is best suited to, and also a direct connection for simple downloading.

For all download links visit the app Google Play Store list. Users are always suggested to download the best saving money apps from Google Play or an authorized app store.

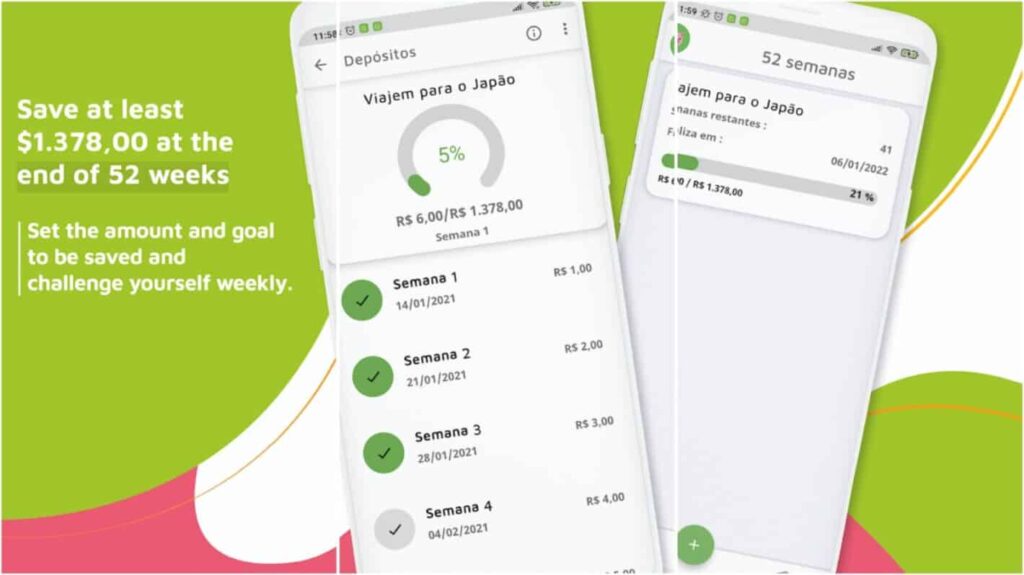

52 Weeks Money Challenge

The very first app on the listing is really really great. This app is also called”52 Weeks Money Challenge”, and its title is very revealing. If you are having trouble planning your expenditures, and just can’t save money, this app ought to have the ability to assist. The app’s objective is to help you to save money during the course of a single year. The app will induce you to save a specific sum of money on a weekly basis.

The first idea is to save more and more money as you progress. The very first week you are supposed to save $1, the next week, $3 the next week, etc. At the end of this challenge, at the 52nd week, you must save 52. You get an overall idea. But if you include all that app, you need to be able to save 1,378 following 52 weeks. It’s possible, of course, to save more, or even not, based on what’s in your reach. The purpose would be to double your stored amount per week, however.

Thriv

Thriv is an app packaged with attributes, which provides a great layout. This app functions in a fairly straightforward manner, however. Thriv will request that you announce your objectives. Therefore, by way of instance, if you would like to save a bit of money to purchase a new smartphone, then do write down the particulars. The same is true for anything else, actually. As soon as you do this, the app will inspire you to attain your objective.

You will have the ability to monitor your savings advancement this way and will observe the purchase price of the thing (or anything else) you need decrease as time passes. You would be amazed just how much easier it would be to save money on something as soon as you detail everything, and have a continuous reminder. Do not take loans out to acquire something, just set aside money to receive it.

Piggy Goals

Piggy Goals is really a somewhat similar app to Thriv. It works in a similar manner, it asks you to announce your objectives, then it attempts to help you achieve them. Piggy Goals does provide an entirely different layout, however, and marginally different features in comparison to Thriv. You should try out both save money apps, however, as these are really excellent, and odds are that one of these will match you.

This app can function as an overall piggy bank, or as a means to reach daily weekly or monthly money-saving objectives. The app offers graphs so that will assist you to visualize your own progress. You may create as many targets as you need, and the app can send you notifications to let you spend less. You do not require an online connection so as to use this app, incidentally. The saving app UI is excellent also.

Save.ly

Save.ly is somewhat like both Thriv and Piggy Goals apps. It does include an entirely different layout, and though the overall assumption is similar, it does it in a slightly different manner. You will not require all three of those apps, merely one, but wanting all of them out might be a fantastic idea. This app also lets you make your own money-saving goals by defining exactly what you need to purchase.

You may also incorporate a picture for your goal, so you have any visual motivation too. You are able to keep help your save money app daily, weekly, or yearly money-saving goals by utilizing this app. Establish dates, create different limitations or targets. This best app to help save money does not go forward with the number of features it provides, but it does exactly what it is supposed to perform very well, along with the visual presentation is superb.

Also read: 5 Best Apps to Budget Your Finances

My Piggy Bank

If you’re searching for a very simple app to attain your savings goals, My Piggy Bank is a saving plan app an excellent option. This app not only includes a very pleasant-looking, and simple UI, but the entire performance of this app is rather straightforward. This app is supposed to function as an authentic digital piggy bank, which permits you to establish your objectives, and deadlines to achieve them.

My Piggy Bank can synchronize data across devices, while it allows you to add a number of goals, along with images for them. The app supports tons of currencies, so you should be good to go no matter where you live. Custom date format is on offer, while you can backup your data locally as well if you want. This app is surely worth trying out, especially if you’re looking for something simple.

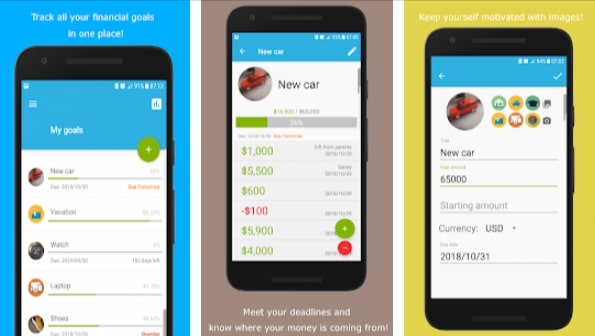

Savings Tracker

![]()

If you’re searching for a very reliable offline money-saving / savings money tracker apps for Android, this is a fantastic option. Savings Tracker provides a very easy UI, although its performance is straightforward, that is not a bad thing in any respect. It offers a number of attributes, more than many men and women need. This app that save money can allow you to compute your earnings and your finances, so you can save as much money as you can.

You are able to produce money-saving goals on your own. These apps to help save money also lets you inspire yourself by setting your savings goals, not only the sum, but things you are likely to purchase, or whatever you’re saving money for. You can place reminders through the app’s settings, though you may synchronize information between devices easily. Themes and colors are also available, however, a few of those attributes require that your cover-up.

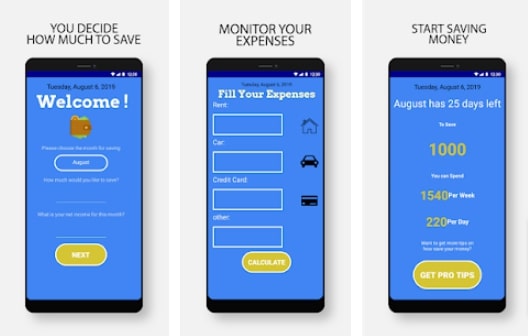

How To Save Money

The way to save money is a really best money app with a fairly easy, and simple name. This is only one of the easiest apps on the listing. The app does not include many attributes, but it does exactly what it is designed for quite nicely. This app’s UI is truly easy too, as well as the UI components are also rather large. That having been said, all you have to do once you download the app is set your objectives, income, and expenditures, as they happen.

It is possible to put your daily, weekly, and daily funding, then follow it. If you want to save a specific sum of money, just place your daily, weekly, and monthly funding so. Be certain that you abide by the tastes as soon as they’re put, however, otherwise there is no purpose in the savings plan app.

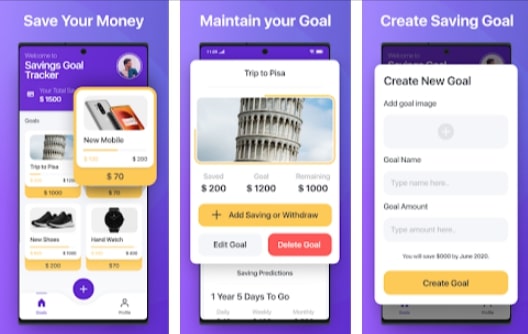

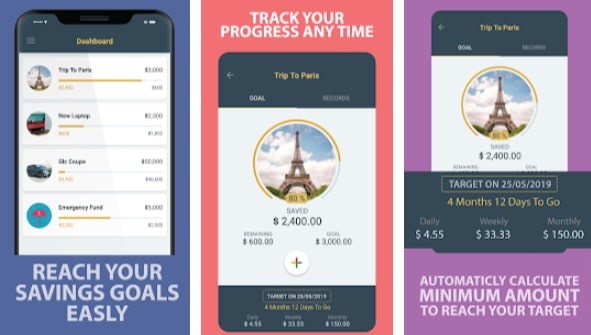

Savings Goal

Savings Goal is still another app that can allow you to save money by specifying the expenses that are planned. Consequently, if you want to travel someplace, purchase a car, or anything else, then you can specify it in this app. You will have to place the sum required for the cost and begin saving money so as to get to the aim. There are few features included in this app, but the app UI is superb. That is, undoubtedly, among the best-designed apps on the listing.

This app lets you make infinite savings goals. Additionally, it lets you bring a picture for each and every goal you produce. You are able to put dates to your money-saving objectives, and see that your daily, weekly, and yearly savings. If you do not want those additional features that complicate matters quite a bit, this app really is a pleasure to use. The free savings app works great, although it seems really nice also, and it is well worth trying out.

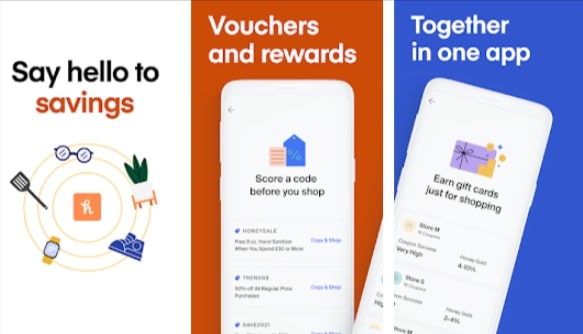

Honey

Honey is completely different than any other app on this list. This app’s goal is to save you money while you’re shopping online. Do note that this app is focused on the US, UK, and Canada, though. It can save you money while you shop at 300+ stores in the US, including Target, Walmart, Best Buy, and much more. The app will offer you a ton of deals, plus coupon codes, and rewards.

It is also extremely easy to use. You can browse between a ton of products within the app. The best saving apps of all? You can even use this app as a browser extension, and let it find coupons for you, while you shop. Honey can save you quite a bit of money, though it will depend on where you shop, of course. The ease of use is on another level, as somewhat similar apps tend to complicate things way too much.

Leave a comment